Over Your Head With Business Debt?

We Can Help You!

We Have Settled MILLIONS of Dollars For Our Clients. Let us assist you with:

- Managing your cash flow

- Paying out one company instead of many

- Reducing your draft by as much as 50%

- Helping your business get out of hardship once and for all

CALL NOW TOLL FREE 833.935.1200

TO SPEAK TO A CONSULTANT TODAY!

By submitting your information you agree to our Privacy Policy and Terms of Use

Program Benefits

Reduced

Collection Calls

We reach out to your lenders and notify them that you are being represented by us. All future contact will move through us; giving you the peace of mind you deserve.

Custom-Made

Programs

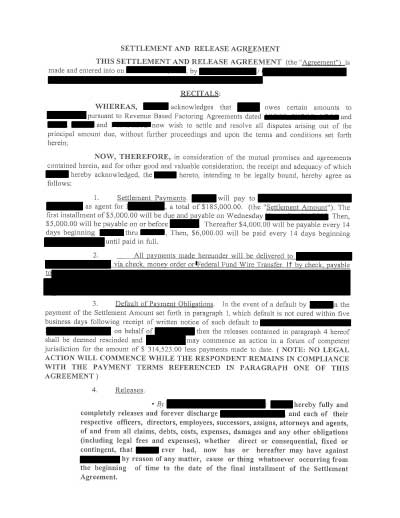

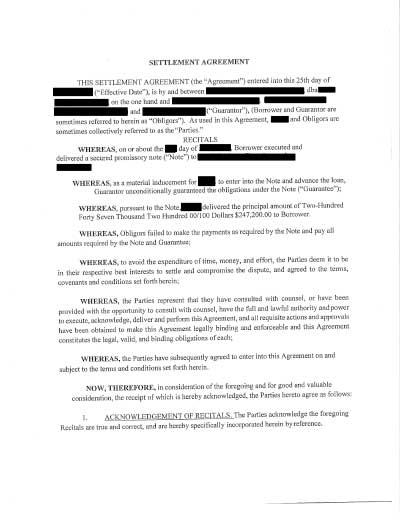

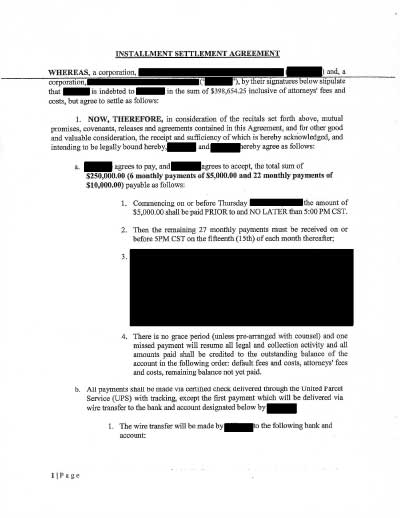

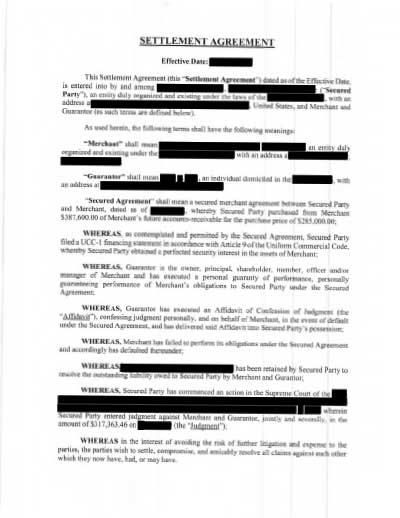

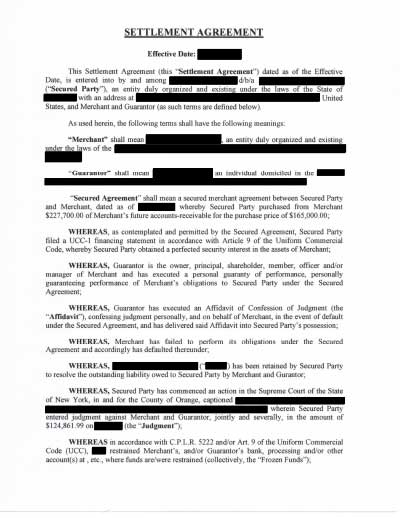

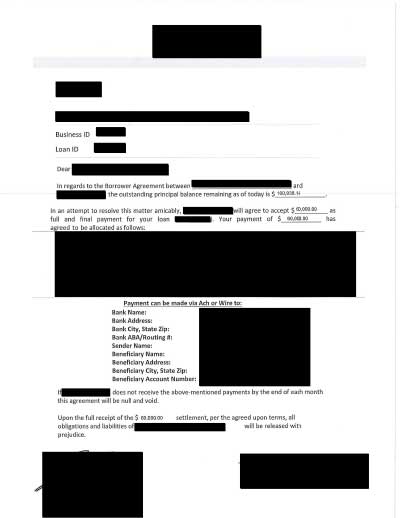

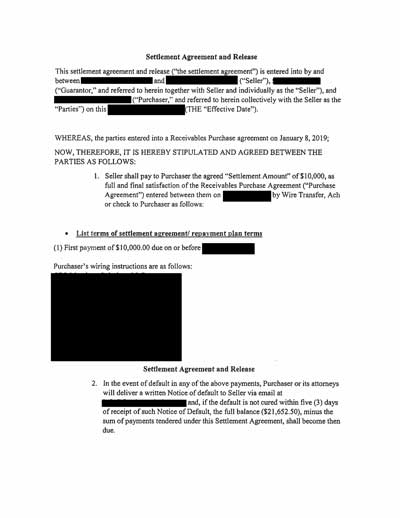

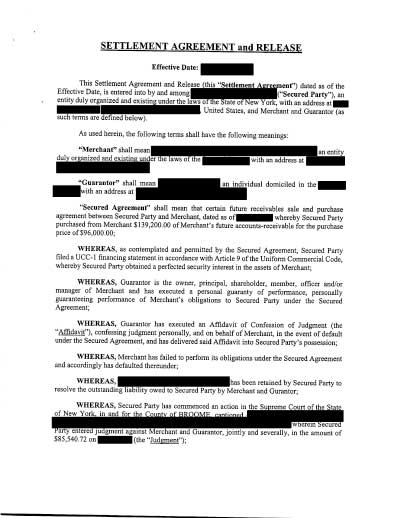

Custom-made programs are created to achieve a successful merchant cash advance settlement. We have plenty of experience handling advances with some of the largest lenders nationwide. Our strategies result in settling your debt for a reduced principal balance or creating reduced payment plans.

Decreased

Easy Payments

We often settle and reduce your payment by as little as 50 percent, and can lengthen your payment terms resulting in saving you thousands. We are unable to predict just how much you will save but our reviews speak for themselves.

If you answer Yes to any of these questions, it is essential you for you to call us today!

- Do you currently have more than one advance?

- Does your cash advance lender get paid before you do?

- Do you have negative balances or bounced checks in your business account?

- Have you seen a drop in your income since taking out your cash advance?

- Have you taken out more than one advance in the last year?

- Are you late on your payroll, rent, or any other essential bills?

- Do you have maxed out business or personal credit cards?

- Do you see yourself needing another cash advance after this one?

With our 5-step process, we can settle your Merchant Cash Advance Debt

Step 1

Lending Agreement

Step 2

Free Consultation

Step 3

Submit Application

Step 4

Conduct Underwriting

Step 5

Settlement Savings

Service Areas

- Small Business Debt Consolidation – Making payments to multiple lenders with different payment terms can be a very stressful activity. Especially if the payments are automatically taken from your accounts. Let us put you in one reoccurring draft, based on your ability to pay.

- Merchant Cash Advance/Working Capital settlement– Merchant cash advances are a great way to get cash into your business quickly. They are also a great way of tying up your cash flow. The high interest and fees associated with the process often lead merchants to take a second advance. This process is known as stacking and tends to often lead to a business defaulting on their bills. Let us negotiate down your balances and put you in control of your business cash flow.

- Small Business Debt Settlement – Small business debt generally is either secured (asset based) to the unsecured (merchant advances and credit cards.) Unsecured business debt can become burdensome and can occupy the cashflow that you need for more immediate bills and the growth of your business. Small business debt settlement can be the solution you need to not only pay off a large portion of your principal and also stop the interest payments. We give you one payment that you can afford, monthly. Take control of your cash flow!

- Business Bankruptcy Alternative – If you are overwhelmed with business debts and can no longer maintain your payments, bankruptcy maybe an option. The problem with bankruptcy is the permanence. Depending on the Bankruptcy you choose, you may also have to pay back your principal debt. Filing for bankruptcy makes it much more difficult to qualify for business loans. Debt settlement creates a similar result without the red mark on your business that bankruptcy brings.

- Business Credit Card settlement – If you have maxed out credit cards, making minimum payments on your business credit card debt can be expensive trap causing thousands of dollars of additional interest every year. Let us settle your business credit card debts while helping you pay back just a portion of your balance. We would drop down your monthly payments to something you can afford with almost all of going towards your principal.